14

How to do a step-by-step bank reconciliation

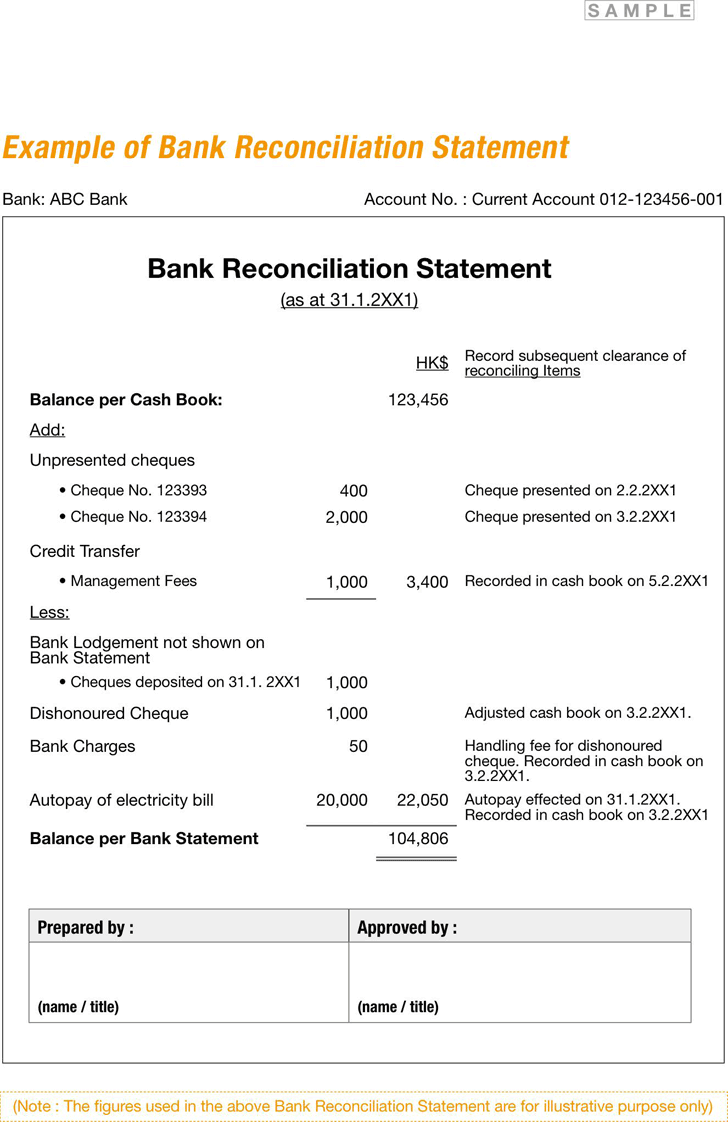

If done regularly, a bank reconciliation easily helps you identify discrepancies so that you can adjust them. It’s possible there are additional transactions on the bank statement that you may not have in your records. Find out the reason for the additional or missing bank transactions before making adjustments. Doing a bank reconciliation is fairly simple, but you need to be diligent in your efforts and avoid skipping steps to ensure the right checks and balances. Next, check to see if all of the deposits listed in your records are present on your bank statement.

Why You Can Trust Finance Strategists

At times, the balance as per the cash book and passbook may differ due to an error committed by either the bank or an error in the cash book of your company. In addition to this, the reconciliation process also helps keep track the occurrence of fraud, which can help you control your business’ cash receipts and payments. To do this, businesses need to take into account bank charges, NSF checks, and errors in accounting. The first step involves identifying any deposits and checks that the bank has not processed at the statement date.

Get in Touch With a Financial Advisor

If you use accounting software, then your reconciliation is done largely for you. However, as a business owner, it’s important to understand the reconciliation process. Error in a payment to a creditor, which was correctly processed by a bank as $2,435 but recorded in the cash book as $2,345. Some transactions generally accepted accounting principles first appear in a bank statement before they are entered into the cash book simply because the business is unaware of their existence until it receives the bank statement. Plan to complete reconciliations monthly so you don’t risk accumulating a large number of discrepancies, which could be difficult to track.

Bank Reconciliation Statement: Explanation

The reconciliation process allows a business to understand its cash flow and manage its accounts payable and receivable. Here are a few reasons why reconciling your bank statements is so important. Since you’ve already adjusted the balances to account for common discrepancies, the numbers should be the same. NSF (Not Sufficient Funds) checks that have been dishonored by a bank due to insufficient funds in the issuer’s bank account.

- Similarly, some checks credited to the ledger account will probably not have been processed by the bank prior to the bank statement date.

- The reason could be that deposits are in transit or outstanding checks have not yet been reflected.

- Kevin has been writing and creating personal finance and travel content for over six years.

- If not, add the missing deposits to your records and your total account balance.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- This is especially common in cases where the check is deposited at a different bank branch than the one at which your account is maintained, which can lead to the difference between the balances.

Do you own a business?

Banks often record other decreases or increases to accounts and notify the depositor by mailed notices. Once you’ve completed the balance as per the bank, you’ll then need to work out the balance as per the cash book. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

The purpose of reconciling bank statements with your business’ cash book is to ensure that the balance as per the passbook matches the balance as per the cash book. Your bank may collect interest and dividends on your behalf and credit such an amount to your bank account. An outstanding check refers to a check payment that has been recorded in the books of accounts of the issuing company, but has not yet been cleared by the bank as a deduction from the company’s cash balance. Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank.

There are times when your business will deposit a check or draw a bill of exchange discounted with the bank. These deposited checks or discounted bills of exchange drawn by your business may get dishonored on the date of maturity. As a result, the bank debits the amount against such dishonored cheques or bills of exchange to your bank account.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. (e) Standing order payment of $1,500 (for rent) also fails to appear in the cash book. At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc.

A bank reconciliation is an essential process for ensuring that your company’s financial statements match the available cash in your business bank account. Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. The frequency of bank reconciliation can vary based on your company’s specific needs. Some businesses balance their bank accounts monthly, after receiving their monthly bank statements. However, businesses with a high transaction volume or increased fraud risk may need to reconcile more frequently, sometimes even daily.

More frequent reconciliations, weekly or daily, increase efficiency as there are fewer transactions to process at any one time and issues are detected sooner. Errors in calculation or recording of payments are more likely made by business staff than by a bank. A bank recon helps you manage your cash flow, enabling you time your income to ensure you have sufficient funds for expenses. So, to reconcile the amounts, you simply add the additions (interest income) and subtract the subtractions (bank charges and overdraft fees) to reach the bank balance.

These outstanding deposits must be deducted from the balance, as per the cash book, in the bank reconciliation statement. The balance recorded in the passbook or the bank statement must match the balance reflected in the customer’s cash book. It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank. Keeping on top of your bank reconciliation ensures that you’re always aware of your company’s financial situation. This helps you anticipate any cash flow challenges so you can respond appropriately. Financial accuracy is also important for ensuring that all payments have been fulfilled and orders have been completed.